Ways to Give

-

You can use our online donation form to give in a number of ways in addition to the standard one-time credit card gift including Paypay, Venmo, Credit Card, ACH Bank Transfer.

-

By becoming a monthly donor, you help provide a reliable, sustainable revenue stream for YWCA Boulder County that keeps our programs running smoothly, and you might be able to make a larger contribution by spreading payments out over the year. You can opt out of the monthly giving program at any time.

Click here and select the “Donate Monthly” option.

-

Electronic Funds Transfers: (no processing fee)

Financial Institution: BOK Financial, Boulder, CO 80302-4822

Account # 3543110

ACH Bank Routing #: 102000607

-

If you prefer to donate by check, please make your check out to “YWCA Boulder County” and mail it to:

YWCA Boulder County

2222 14th Street

Boulder, CO 80302 -

Many companies offer matching or workplace giving programs as an added benefit to their employees. Your donation could be doubled or even tripled by employer gift matching.

Check with your employer regarding gift matching and workplace giving.

Please contact Susan at shirano@ywcaboulder.org with questions, or to let us know that your gift will be matched by your employer.

-

Celebrate an important milestone, such as a birthday or anniversary, or remember a loved one through an honorary or memorial gift to YWCA Boulder County.

If you would like to learn more about this option, please contact Susan at shirano@ywcaboulder.org.

-

If you have a Donor Advised Fund, you have already set aside those dollars to support nonprofits you appreciate. Make a gift today to YWCA Boulder County to have those dollars support our work to empower women and eliminate racism right away!

Learn about the Half My DAFmovement

Please note: Gifts made from Donor Advised Funds are not eligible for tax deductions or the Colorado Child Care Contribution Credit.

-

We welcome your gifts of stocks or other appreciated securities. Transfers can be made through Charles Schwab:

DTC #: 0164

Custodian: Charles Schwab

Account: 3064-2568

Account registration: Young Women’s Christian Association (YWCA) of Boulder

Schwab’s transfer department: 1-888-667-1676Please alert us of your gift of stock by contacting Susan Hirano at shirano@ywcaboulder.org

Please note: Gifts of stocks or other appreciated securities are not eligible for the Colorado Child Care Contribution Credit.

-

Help us secure the future! Many planned gifts are easy to initiate and revocable if circumstances change.

Three simple ways are to:

Include YWCA Boulder County in your will or trust

Name YWCA Boulder County as a full or partial beneficiary of a retirement account or IRA

Name YWCA Boulder County as a full or partial beneficiary of a non-retirement investment or life insurance policy

Click here to read more.

-

If you’re 72 or older, transferring funds from your IRA may provide a way to make a generous gift to YWCA Boulder County while reducing your overall tax burden. You may transfer up to $100,000 per year directly from a traditional or Roth IRA, avoid reporting the distribution as income, and have an immediate impact on our work to empower women and eliminate racism. If your spouse has a separate IRA, he or she is also eligible to make a charitable IRA rollover gift. The amount of the transfer will not be included in your taxable income, and the transferred amount counts toward the IRA’s required minimum distribution.

Please note: there is no charitable tax deduction for an IRA charitable distribution gift. Please contact your financial advisor to demonstrate the power of a Charitable IRA Distribution.

-

There’s an easy way to give some, or all of your Colorado State income tax refund as a charitable donation. It’s a fast and simple way to support YWCA Boulder County.

Visit refundwhatmatters.org to learn more. When you complete your state tax return, enter registration #20023006070 for YWCA Boulder County.

-

Your company or organization can put its values into action by sponsoring one of YWCA Boulder County’s fundraising events.

Sponsorship benefits are flexible and can be customized according to your needs.

If you’re interested in sponsoring an event, please contact Susan Hirano at shirano@ywcaboulder.org.

-

Donate your vehicle to support YWCA Boulder County through Vehicles for Charity!

Instead of selling, trading, or storing your unneeded vehicle, you can donate it, support YWCA’s work in the community, and receive a tax deduction.

Please note: there is no charitable tax deduction for an IRA charitable distribution gift. Your financial advisor can provide information to demonstrate the power of a Charitable IRA Distribution.

-

You can fundraise by yourself or with friends.

Celebration fundraiser: birthday, anniversary, or special event

“Give-It Up” Fundraiser

Hike/Bike/Walk a-thon

Viral Social Media Challenge

Personal/Small Group Challenge: 14er hiking

If you would like to learn more about this option, please contact Susan Hirano at shirano@ywcaboulder.org.

-

Earn money for your favorite community organization when you use your loyalty card.

Log in or create an account at kingsoopers.com, go to My Account, click Community Rewards along the left menu, and then select YWCA Boulder County.

What Your Donation Can Do!

Buy books for inclusive activities in local schools for Reading to End Racism

Stock supplies for Persimmon Early Learning

Supplement child care activities with fields trips, fitness classes, and nutritious meals

Pay for STEM E3 workshops for middle school girls

Underwrite community events for Racial Justice & Equity Education and Advocacy

Support the hiring of Young Women+ Achievement mentors for local high school

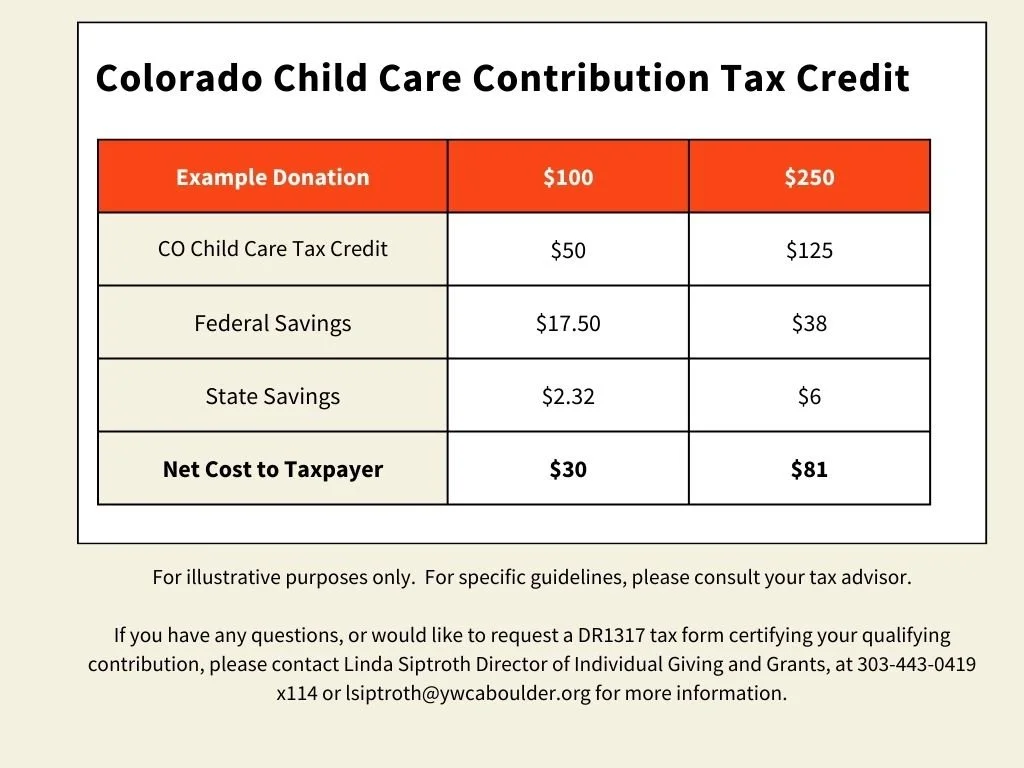

Colorado Child Care Contribution Tax Credit ↘

When you make an unrestricted cash donation to YWCA Boulder County, you may be able to reduce your taxes through the Colorado Child Care Contribution Credit, which decreases the after-tax cost of gifts by more than 50%.

If you qualify, half of your donation to YWCA Boulder County will be offset by a dollar-for-dollar credit against your Colorado income taxes. In addition, you will still be able to claim your full contribution as a charitable deduction on your federal and state income tax returns if you itemize deductions.